The Ethereum network has seen notable progress with the implementation of the Dencun upgrade, which aims to reduce transaction fees on its Layer-Two (L2) networks. This development could contribute to the increased use of Web3 platforms and may affect the direction of Ethereum’s (ETH) value.

The core developers of Ethereum marked a milestone on Wednesday by activating the Dencun upgrade. This strategic update brings a much-needed reduction in transaction costs across various Ethereum-based L2 solutions, including industry leaders like Arbitrum, Optimism, Polygon, and Starknet.

Read also: Ether ETF Approval Odds Dip to 35% Amid SEC Silence, Analysts Say

One notable beneficiary, Starknet, reported a dramatic decrease in gas fees following the upgrade, with costs dipping to an approximate range of $0.01-0.04 from a previous rate of around $2. This represents a significant cost reduction, making transactions on the network more accessible and affordable.

gm blobs.

happy swapping pic.twitter.com/1vZH6K0xhJ

— Starknet 🦇🔊 (@Starknet) March 13, 2024

Navigating Competitive Waters

Ethereum’s journey toward optimization does not stop with the Dencun upgrade. The network faces formidable competition from other Layer-One blockchains, such as Solana, Cardano, and BSC, known for their low transaction fees and supportive ecosystems for decentralized applications (DApps).

To maintain its competitive edge, Ethereum boasts an array of around 45 L2 scaling solutions, each employing diverse technologies like StarkEx and zkSync Lite. These innovations are integral to Ethereum’s strategy to provide cost-effective transaction options, ensuring the network remains a preferred choice for users and developers, even during periods of high congestion.

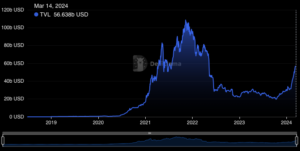

The Ripple Effect on ETH Price

The Ethereum network’s consistent enhancements, culminating in the Dencun upgrade, have positively impacted the ETH price. In four weeks, the price of ETH surged by approximately 50%, reaching a value of around $3,984.62, according to CoinStats data. This upward trajectory can be attributed to the robust growth of Ethereum’s Web3 ecosystem, which currently showcases a Total Value Locked (TVL) of about $56 billion and a stablecoin market capitalization surpassing $77 billion.

Source: DefiLlama

The ongoing bullish sentiment in the cryptocurrency market further bolsters Ethereum’s position. If this trend continues, the ETH price is likely to scale new heights, potentially setting a new all-time high that parallels Bitcoin’s recent achievements.