Ethereum has displayed notable stability despite the broader market’s downturns.

According to data analyzed from Daan Crypto Trades, while the general sentiment around cryptocurrencies wavers, Ethereum has managed some noteworthy achievements. The asset’s performance, particularly its fee structure and market value, reflects a nuanced landscape of digital currencies facing regulatory and economic challenges.

$ETH Has retaken the range.

Key to hold above that ~0.049 level from here on out.

Besides that, I'm not overcomplicating things. https://t.co/xTDqbpiMr4 pic.twitter.com/GG8UCpRCMS

— Daan Crypto Trades (@DaanCrypto) April 28, 2024

ETH Holds Above Key Level

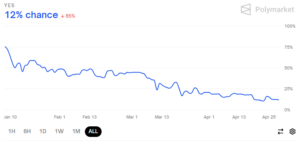

Ethereum has recently regained its footing in a significant price range, crucially holding above the 0.049 level. This stability is critical as the cryptocurrency ecosystem navigates through uncertain regulatory environments, highlighted by the decreasing probability of an Ethereum Spot ETF approval, now standing at about 12% as per Polymarket. With the deadline for ETF approval looming in a month, Ethereum’s price and market dynamics could be poised for more significant shifts.

A key indicator of market sentiment towards Ethereum can be seen in its transaction fees, which have fallen to an average of $1.12 per network transaction, the lowest since October 18th of the previous year. This decline in fees typically suggests a reduction in network strain and can precede a turnaround in market interest and prices. Historical trends suggest that transaction fees peak around price tops and decrease towards price bottoms, providing a cyclical insight into investor sentiment and market health.

Current Standing

Despite a general market retracement over the past six weeks, Ethereum has outperformed the broader cryptocurrency market. While the global cryptocurrency market has seen a 5.50% decline, Ethereum has reported a modest 0.27% increase over the past week. As of the latest data, Ethereum’s price stands at $3,203.90, with a market capitalization of approximately $390.88 billion, underlining its resilience and pivotal role in the cryptocurrency space.

As the market continues to adapt and respond to both internal and external pressures, Ethereum’s role and performance will likely be a critical barometer for the cryptocurrency sector’s health and trajectory. With reduced transaction costs and stable market performance, Ethereum could potentially lead a market turnaround, should investor sentiment and regulatory landscapes permit. The coming weeks, especially with the ETF deadline approaching, will be crucial in shaping the near-term future of Ethereum and potentially, the broader altcoin market.