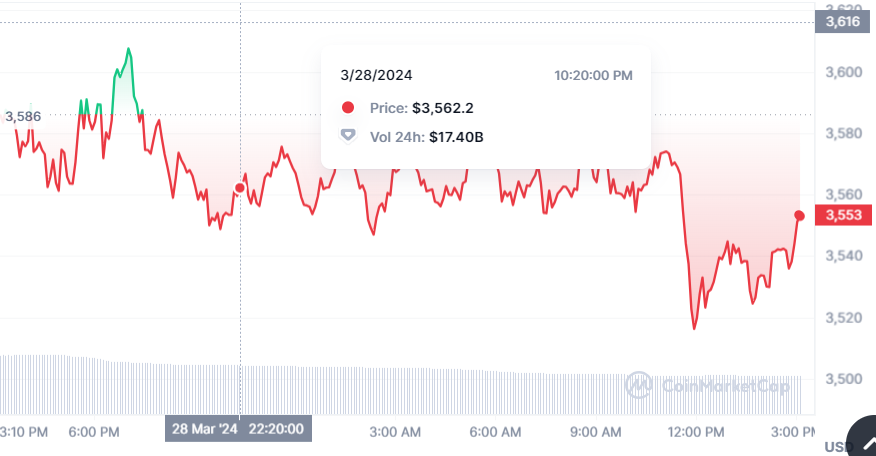

Amidst the latest market developments, Ethereum maintains a steady trading level near $3,600, indicative of the market’s consolidation phase. Growing institutional interest and the anticipation of ETF approvals are key factors influencing investor sentiment.

Ethereum price analysis shows ETH is presently in a consolidation phase, with its price relatively stable at approximately $3,542.53. Even with considerable institutional attention and the recent submission for a spot Ethereum ETF by Bitwise Asset Management to the SEC, Ethereum’s market price is confined within a narrow band, reflecting a cautious stance among investors at these price points.

Ethereum, at the time of writing, is trading just above the critical Fibonacci level of 0.382 at $3511.9, a point often associated with the possibility of a trend reversal or continuation. A daily close above this level could reinforce the bullish scenario, while a breach below could indicate that a short-term top is in place and that a correction is underway.

Read also: Ethereum Co-Founder Questions Metaverse’s Practicality

ETH Trades Above Major Simple Moving Averages

The price is also contending with the influence of its Simple Moving Averages (SMAs). Currently, Ethereum stands above its 50-day SMA ($2488.3), 100-day SMA ($2336.6), and 200-day SMA ($2022.2), suggesting that the long-term trend remains in favor of the bulls. However, the price’s proximity to these indicators might attract buyers looking to capitalize on potential support levels.

From a broader perspective, the entire crypto market has been treading with caution. Ethereum’s relatively flat movement on the day mirrors the market’s search for direction, as investors and traders alike assess the impact of global economic cues on digital assets.

With a 24-hour trading volume indicating a less active market than the previous day, Ethereum’s current price stability might not infer immediate action but rather a consolidation phase as it gears up for its next significant move.

Looking forward, the path of least resistance appears to be upward, provided Ethereum can maintain its hold above the aforementioned Fibonacci level. Should buyers step in with vigor, pushing the price past the immediate resistance at the 0.5 Fibonacci level of $3637.5, we could very well see Ethereum targeting the 0.618 level at $3745.3. This would be in line with the bullish momentum that has characterized Ethereum’s journey this year.

Conversely, a turn of the tide leading to a drop below the current levels might see Ethereum retreat towards the $3051.6 area, where the 200-day SMA lies in wait to potentially serve as a robust support zone. A fall to this SMA could attract buyers banking on the long-term bullish trend to resume.

Read also: Market Analysts Eye XRP for Potential Bullish Swing

Ethereum Oscillates Near $3,553 Amidst Balanced Market Sentiment

On the hourly chart, Ethereum (ETH) is exhibiting a tight trading pattern around $3,540. The Simple Moving Averages (SMAs) are closely huddled together, with the 50-period SMA at $3,568, the 100-period at $3,467.9, and the 200-period at $3,429.1, suggesting a consolidation phase without a clear trend.

The Bollinger Bands Percentage (BBP) indicator shows ETH is trading near the midline, reinforcing this consolidation phase. The lack of significant movement in the BBP also aligns with the narrow Bollinger Bands on the chart, indicating low volatility in the market. For a decisive move, traders would look for a breakout above the immediate SMA resistance or a breakdown below the 200-period SMA support, which could signal a new directional trend.

With the trading volume witnessing a notable decline in the last day, Ethereum’s path forward remains hinged on market sentiment and key technical levels. As the cryptocurrency landscape continues to evolve, Ethereum’s reaction to these pivotal price junctures will be telling of its capacity to sustain its growth trajectory or recalibrate in the face of selling pressure.

Ethereum’s co-founder, Vitalik Buterin, has issued a clarion call on Twitter for the Ethereum community to significantly bolster its security protocols.

Ethereum has blobs. Where do we go from here?https://t.co/P2cyf9sCwb

— vitalik.eth (@VitalikButerin) March 28, 2024

In a recent tweet, Buterin underscores the urgent need for Ethereum to escalate its security measures, setting a goal for the community to adhere to higher standards by year-end. This push for enhanced security comes as the platform continues to expand its reach and influence in the broader blockchain ecosystem.