Dogecoin (DOGE) has officially claimed to be the most profitable major meme coin title. Data from IntoTheBlock reveals that Dogecoin leads with the highest “in/out of the money” ratio. With 72.64% of addresses in profit, Dogecoin stands out in its market segment.

This figure encompasses 4.65 million addresses holding 70.3 billion DOGE, valued at approximately $7.39 billion. Consequently, 48.3% of Dogecoin’s total market capitalization is currently in profit.

In comparison, Floki Inu (FLOKI), Dogecoin’s nearest competitor, has 70.49% profitable addresses. These addresses hold tokens worth about $965.2 million. However, DOGE’s superior profitability metric underscores its leading position in the meme coin market.

Dogecoin’s current price is $0.106318, with a 24-hour trading volume of $619,662,511. The coin has fallen by 0.87% in the previous 24 hours. Its market capitalization is $15,471,201,714, with a circulating supply of 145,518,636,384 DOGE.

Source: TradingView

The daily relative strength index (RSI) for Dogecoin is 45.28. This level implies that the coin is not overbought or oversold. As a result, market sentiment remains neutral, with not much directional bias for price movement. The Moving Average Convergence Divergence (MACD) line aligns with the signal line, suggesting a possible trend reversal or continuation.

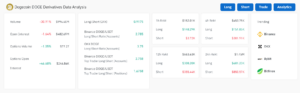

In the derivatives market, sentiment is mixed. Trading volume has decreased by nearly 28%, and open interest has dipped by 1.66%. This reduction signifies decreased activity in DOGE derivatives. Additionally, options trading has notably fallen by 81% in volume. Despite this, options open interest has risen by 9.38%, indicating some traders are retaining positions amid lower activity.

Source: Coinglass

Moreover, platform-specific data presents a more optimistic view. Binance and OKX exhibit higher long/short ratios among top traders. Binance’s ratio stands at 2.5511, and OKX’s is 3.67. This suggests a stronger bullish sentiment on these platforms.

Nonetheless, the overall market remains volatile. Recent data shows $2.50 million worth of positions were liquidated over the past 24 hours. Hence this volatility reflects mixed and uncertain sentiment around Dogecoin in the derivatives market.