Cash App, a payments application developed by Square Inc., currently Block Inc., has announced that it will end its business in the United Kingdom after six years of active operations in the finance market.

Over the past years, the platform has shown rapid growth in the USA since its launch in 2013. The app’s ability to perform various actions has made it a versatile tool for managing finances. Cash App has been in service for half a decade as a financial service platform where its users can spend, send, and buy stocks and Bitcoin using the popular app.

The app’s main feature has been peer-to-peer money transfers, making it simple to receive money in bulk with a single tap through phone numbers and emails. Additionally, the app has allowed online and in-store purchases through cash cards that act as debit cards, just like those used in banks.

The decision to withdraw from the UK market affects many, including customers who relied on the app for various financial services and the partners and team members who contributed to its development and growth.

Cash App’s exit from the UK underscores financial service platforms’ challenges in maintaining operations across different markets. The platform’s US success story highlights its innovative approach to financial management, but adapting to different regulatory and market conditions remains a significant hurdle.

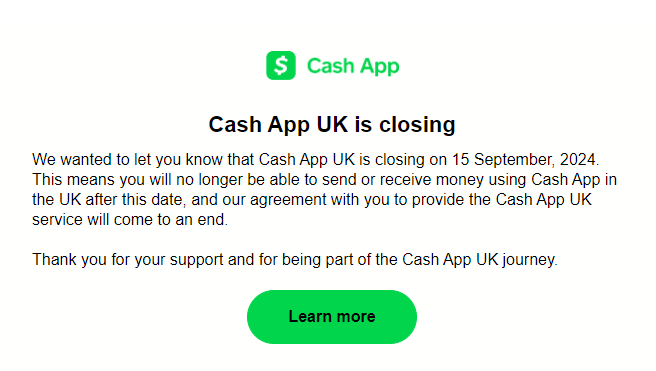

Block Inc. will focus on consolidating its services and enhancing its offerings in its primary markets. As the September 15 closure date approaches, Cash App UK users are advised to withdraw their funds and transition to alternative financial services.

This development marks the end of Cash App’s five-year venture in the UK, reflecting the dynamic nature of the financial technology landscape and the constant evolution of market strategies by global financial service providers.

In a July 18 notice on the payment app’s terms of service, Cash App UK said it would close starting on Sept. 15. According to the app, users can expect “their funds to remain safeguarded until withdrawn, even after our service closes.”

“We do not make decisions like this lightly, as we know they impact our customers, our partners, and our team members who have helped us build to where we are today,” said the app.