Key Insights:

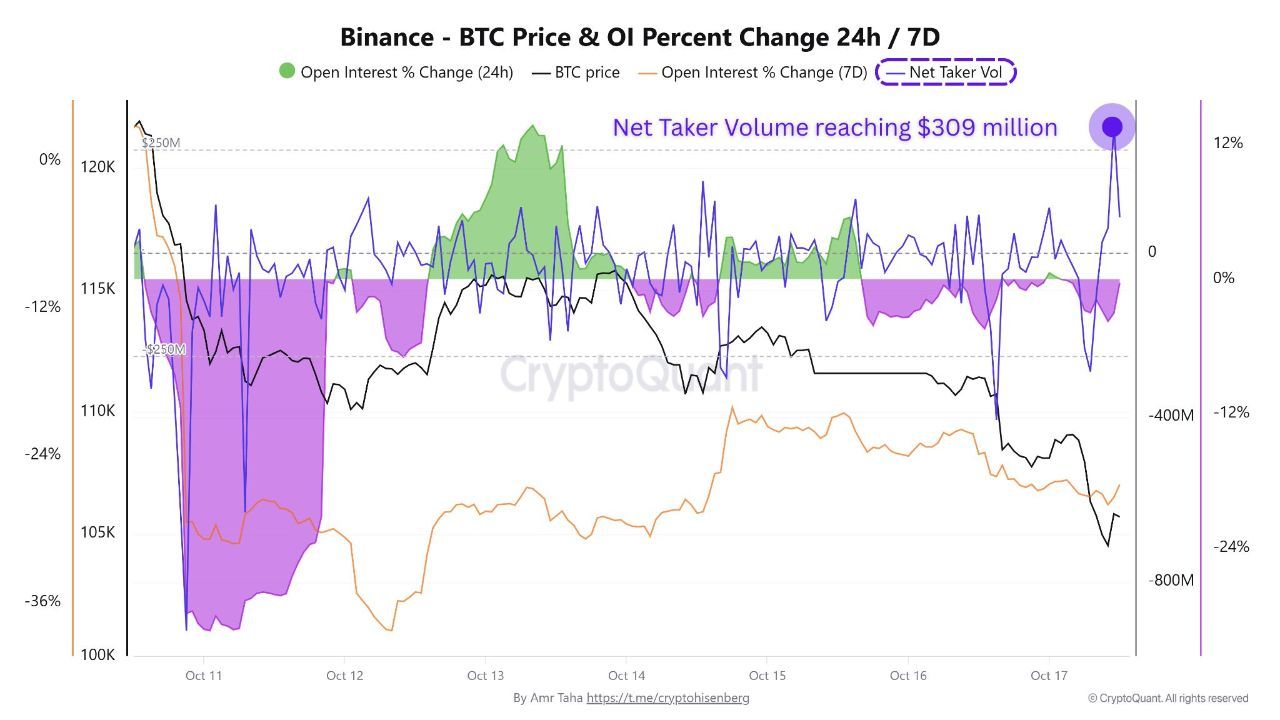

- Bitcoin buy pressure increased to $309 million, showing strong demand despite a market dip.

- Flat open interest suggests traders are focusing on spot accumulation rather than using leverage.

Bitcoin Sees Strong Buy Pressure Amid Market Dip

Bitcoin continues to experience significant buy pressure, even as the market faces a sell-off. Data from Binance indicates that net taker volume hit $309 million, marking the strongest Bitcoin buy pressure since October 10. This surge in buying activity comes despite the overall market downturn earlier today.

Traders are taking advantage of the dip, aggressively buying Bitcoin directly into the market. This suggests that specific traders have confidence, even as retail investors remain more cautious. The increase in buy volume indicates a growing interest in accumulating Bitcoin at lower prices.

Spot Accumulation Without Leveraged Positions

Binance data reveals that open interest in Bitcoin remains flat, indicating that traders are focusing on spot accumulation rather than taking on new leveraged positions. This suggests that buying activity is driven by long-term investors, also known as “smart money,” rather than short-term speculators.

The lack of fresh leveraged positions is notable. It shows that traders are not chasing the market but instead focusing on accumulating Bitcoin at current levels. “Aggressive buying with no leverage build-up is usually smart money loading up,” said one analyst.

Retail Traders Remain Cautious Amid Bitcoin’s Price Action

While professional traders are positioning themselves for future growth, retail investors have been more cautious. The recent market volatility has led to hesitation among many retail traders. They are waiting for more clarity before making significant market moves.

However, the ongoing accumulation of Bitcoin by seasoned traders suggests that they view the current price as an opportunity. This trend contrasts with the behavior of retail traders, who are often more reactive to market movements.