Ripple’s cryptocurrency, XRP, is approaching a crucial convergence point, as recent technical patterns indicate.

In an X (formerly Twitter) post, financial analyst Javon Marks identified an RSI (Relative Strength Index) pattern suggesting strong underlying momentum in XRP prices. He suggests that this development points toward a potential bullish breakout in the near future.

$XRP (Ripple) nears a major converging point and with an RSI Pattern that is currently indicating underlying momentum in prices, a Bullish Breakout is looking likely!

A "conservative" target for a breakout and logarithmic follow-through here could be $15-$20 which could result… pic.twitter.com/XfFNEZb8ZU

— JAVON⚡️MARKS (@JavonTM1) May 20, 2024

Marks further projects a conservative target price range of $15 to $20 for XRP, contingent on current market conditions, should the bullish breakout occur. This potential price surge represents a substantial increase, potentially yielding returns between 20 to 36 times the current value—an impressive gain exceeding 2,000 percent.

Read Also: XRP Whales Transfer 333M Coins Amid Price Volatility

XRP Price Action

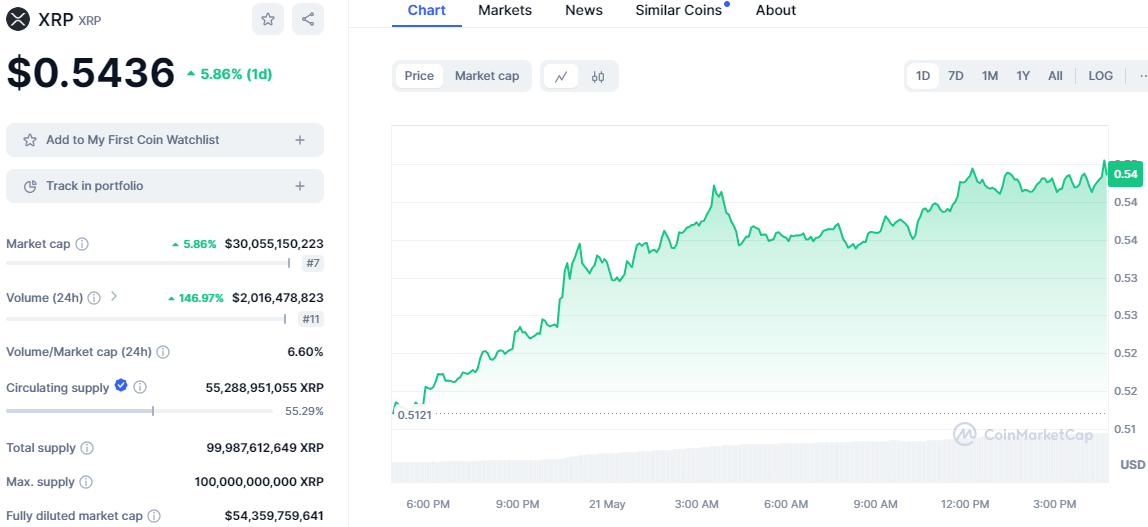

As of press time, the XRP token is exhibiting bullish momentum, with prices reaching $0.5373, reflecting a 5.34% uptick from the previous day. This positive movement has translated into a corresponding increase in XRP’s intraday market capitalization, which has surged by 5.37%, reaching a valuation of $29,728,046,412.

In parallel with the price and market cap increase, XRP’s trading volume has seen a substantial rise. Over the last 24 hours, the trading volume surged by 146.22%, bringing the total to $1,687,319,298. This significant uptick in trading activity highlights a growing investor interest and activity surrounding the XRP token, suggesting a robust market engagement.

XRP Breakout Hints at Upward Rally

The XRP token has broken above the ascending channel that defined its price movements throughout April. This price breakout aligns with XRP’s bullish trajectory, suggesting the potential for an upward rally in the near future.

Presently, the XRP token is stabilizing around the 50% Fibonacci retracement level, suggesting a potential upward surge. If this level holds, XRP may challenge the key resistance at $0.5709, last reached on May 6. A successful move above this resistance could propel XRP higher, targeting the 78.6% Fibonacci retracement level and potentially breaching the April highs at $0.6432.

Conversely, should the 50% Fibonacci level fail to hold, XRP prices could decline. In this scenario, the token might find support at the lower band of the ascending channel before attempting another bull run. However, should this lower band be breached, the token’s price could fall further, aiming for the key support level at $0.4903, last hit on May 13.

On the technical front, the MACD indicator is moving upward above the zero line, indicating robust bullish sentiment for XRP. Positioned at 0.0043 and above the signal line, the MACD suggests there is room for the bullish trajectory to persist in the short term. The MACD’s histogram bars are widening above the zero line, further corroborating the strength of the bullish momentum.

Additionally, the Chaikin Money Flow index is also moving vertically above the zero line. Positioned at 0.32, it indicates a significant influx of money from investors into the XRP token, further supporting the bullish sentiment.