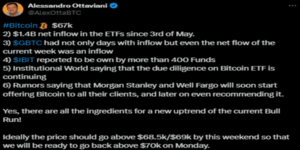

Bitcoin maximalist Alessandro Ottaviani believes that Bitcoin’s price could rebound to $70,000 on Monday due to recent shifts in market dynamics and developments in the ETF sector.

Alessandro Ottaviani, co-host of the Store of Bitcoin podcast, recently shared five reasons why he thinks Bitcoin (BTC) will reach $70,000 next week. His analysis is based on recent market trends and institutional investments, making a strong case for a significant BTC price increase.

5 Reasons Why Bitcoin Will Hit $70K Soon

1. Bitcoin ETF Inflows and Market Strength

The first reason cited by Ottaviani is the substantial net inflow into spot BTC Exchange-Traded Funds (ETFs) since early May 2024. So far this month, ETFs have attracted $1.5 billion, indicating strong investor confidence.

Specifically, on May 17 alone, these BTC ETFs experienced a net positive flow of $221.5 million. Blackrock’s IBIT ETF received $38.1 million, Fidelity Wise’s FBTC led with $99.4 million, and Bitwise’s BITB ETF added $20.8 million. Grayscale’s GBTC ETF maintained its inflow streak with $31.6 million, while the Ark 21Shares Bitcoin ETF (ARK) saw an inflow of $10 million. This week’s total inflow was $948.3 million, a significant shift from April’s outflow of $343 million.

2. Grayscale’s GBTC Inflows

Secondly, Ottaviani pointed out Grayscale’s GBTC ETF, noting that it saw positive inflows on specific days and ended the week with more money coming in overall. This ongoing investment in GBTC shows that institutions are still interested in Bitcoin for the long term.

During the week, $12.3 million more came into GBTC than went out, which is significant considering it had been seeing outflows for 77 days straight. This suggests a change in how the market works, and more people use this ETF. Fewer people taking money out of GBTC could help Bitcoin’s price by keeping more funds in circulation.

3. Institutional Adoption And 13F Filings

Ottaviani highlights the increasing institutional adoption of Bitcoin ETFs. Recent SEC filings reveal that 937 global institutional investors are considering investments in U.S. Spot Bitcoin ETFs, contributing over $10 billion in assets under management (AUM).

The US leads this adoption with around $9 billion in investments. Major American banks like Morgan Stanley and Wells Fargo have disclosed significant Bitcoin ETF holdings, marking a milestone in integrating digital assets into traditional financial systems.

4. Institutional Adoption of BlackRock Bitcoin ETF Soars

The fourth reason highlights the good signs from institutions about Bitcoin ETFs. Reports show that more than 400 hedge funds own BlackRock’s IBIT ETF. This shows that sophisticated investors widely accept and trust this ETF. Since BlackRock’s IBIT is a major ETF, we can also anticipate more adoption for other ETFs.

5. Rumors Of Expanded BTC Offerings

Ottaviani mentions rumors that Morgan Stanley and Wells Fargo may expand Bitcoin offerings to all clients, recommending investment in the cryptocurrency. If confirmed, this would represent a substantial endorsement. It’s likely to attract more retail and institutional investors. Additionally, it could drive the price higher.

He predicts Bitcoin could close above $69,000 by the weekend, setting the stage for a $70,000 breakthrough on Monday, May 20. If achieved, it would be the first time since April that Bitcoin surpassed this threshold.

Also Read: Genesis Gets Court Approval for $3B Payout