Hong Kong’s Securities and Futures Commission (SFC) has recently heightened its scrutiny over cryptocurrency exchanges operating within its jurisdiction on March 15.

In a notable action, the SFC has issued a warning against MEXC, a cryptocurrency exchange, for offering services to Hong Kong residents without the necessary regulatory approval. This move is part of the SFC’s broader efforts to regulate the fast-evolving digital asset market and protect local investors.

The Hong Kong SFC issued another warning today, warning the public to beware of the MEXC unlicensed virtual asset trading platform, and stated that MEXC has been actively promoting its services to Hong Kong investors. Yesterday, the SFC placed Bybit on the warning list.…

— Wu Blockchain (@WuBlockchain) March 15, 2024

Licensing Lapses Lead to Regulatory Warnings

According to the FSC’s statement, the SFC’s warning to MEXC stems from the exchange’s active promotion and provision of services to Hong Kong-based investors without obtaining a virtual asset trading platforms (VATP) license. Such an oversight contravenes the region’s Anti-Money Laundering and Counter-Terrorist Financing Ordinance, which mandates a license for operating virtual asset services. The regulatory body has made it clear that unauthorized operations and marketing targeted at Hong Kong investors are not permissible, emphasizing the potential legal consequences.

Read also: Bybit Under Hong Kong SFC Spotlight Amid Regulatory Concerns

Following closely on the heels of a similar advisory concerning Bybit exchange, the SFC’s alert about MEXC forms a consistent pattern of regulatory actions aimed at safeguarding investors. The commission has repeatedly cautioned against the hazards of trading on unregulated platforms, highlighting the risk of total investment loss if such platforms were to shut down unexpectedly. These warnings reflect the SFC’s commitment to maintaining a safe investment landscape in Hong Kong’s digital asset space.

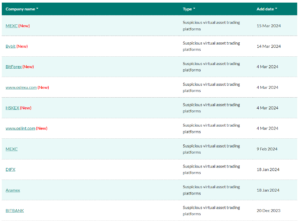

SFC Alert List (Source: SFC)

Despite the regulatory challenges in Hong Kong, MEXC maintains a significant presence in the global cryptocurrency market. According to CoinMarketCap data, MEXC is Ranked as the 11th largest exchange by trading volume, it boasts a robust platform facilitating access to a wide array of cryptocurrencies. The exchange attracts over three million weekly visitors, underscoring its popularity among traders. However, the SFC’s recent action serves as a reminder of the crucial need for compliance with local regulations, regardless of an exchange’s size or global standing.

Hong Kong’s Ongoing Regulatory Endeavors

The SFC has been proactive in its approach to monitoring and regulating the cryptocurrency sector, extending its vigilance beyond mere licensing issues. Previous instances have seen the commission take action against fake websites impersonating licensed crypto trading platforms, reflecting a comprehensive strategy to combat fraudulent activities and protect investors.

Consequently, with the deadline for VATP applications having lapsed and a clear mandate for unlicensed exchanges to cease operations, Hong Kong is on a path to a more regulated and secure cryptocurrency trading environment.

Editorial credit: rafapress / Shutterstock.com