As the crypto community counts down to the highly anticipated Bitcoin halving event, savvy investors are broadening their horizons, searching for alternative investment gems with significant growth prospects. Altcoins like IOTA, Injective ENJ, Fetch.ai, Ethereum, and TONCOIN are drawing attention for their potential to deliver returns.

Amid growing anticipation for the Bitcoin halving set to occur in just 25 days, investors are eagerly adjusting their portfolios, with a notable surge in buying pressure reflecting a bullish optimism in the cryptocurrency market.

This trend has notably shifted focus toward Altcoins, as investors search for diversified investment opportunities with promising growth potential. In this context, certain Altcoins have caught the eye of investors for their lucrative prospects, leading up to what many anticipate to be an exciting altcoin season.

Notable cryptocurrencies with huge potential are IOTA, Injective, Fetch.ai, Ethereum, and TONCOIN, which are seen as potential game-changers in the crypto space. Meanwhile, Bitcoin’s recent surge past the $70,000 mark further ignites the market’s enthusiasm.

1.Fetch.ai (FET)

Fetch.ai (FET) stands out, especially with the growing interest in AI tokens. The token’s interest is propelled by their growing use cases and the spotlight from events like the NVIDIA Artificial Intelligence conference. Fetch.ai, in particular, has seen remarkable growth, with a 12.26% increase in its last session, trading at $2.83.

Yesterday, the https://t.co/kJ9URVpOul team had a wonderful time at the @EconomistEvents Business Innovation Summit #EconBIS.

We'd like to thank everyone who came and showed interest or listened to the AI Agent-focused panel that our CEO & Founder @HMsheikh4 participated in 👋 pic.twitter.com/lmHULE4NXX

— Fetch.ai (@Fetch_ai) March 22, 2024

The token’s year-to-date performance showcases a staggering 697% rally, outpacing 91% of the top 100 crypto assets and trading significantly above its 200-day simple moving average. Predictions for Fetch.ai are optimistic, suggesting a potential rise to $4.14 by 2024.

2. Injective Coin

Injective Protocol (INJ) stands out in the DeFi and blockchain landscape, rapidly gaining traction through strategic partnerships and initiatives aimed at enhancing the ecosystem’s infrastructure. Its collaborations with entities like Noble and Clusters have been pivotal, offering direct USDC access and fostering a seamless user experience across multiple dApps, including HelixApp.

These efforts towards interoperability, notably with Ethereum and Solana, underscore Injective’s commitment to removing barriers within the DeFi space, signaling its ambition and potential to reshape blockchain transactions and accessibility.

As a result of the recent integration with @noble_xyz, Injective gains direct access to USDC issued on the platform ⚡️

Users can access native USDC via a number of dApps across the ecosystem such as @HelixApp_.

Details 👇https://t.co/IP1Tut5MwU

— Injective 🥷 (@injective) March 25, 2024

Market reception to Injective’s advancements has been positive, evidenced by the INJ token’s appreciable growth. The token’s price surge to $40.35 and a remarkable trading volume highlight a bullish sentiment among investors.

Furthermore, INJ’s performance is well above the 200-day simple moving average, and a notable Greed score reflects strong market confidence and anticipation for further growth. Injective’s position as a significant player in the AI crypto sector, marked by high liquidity and investor interest, showcases its promising trajectory and the potential for continued innovation and impact within the blockchain community.

3.THORChain

THORChain (RUNE), similarly, has witnessed a significant uptick in its market activity, approaching its peak performance levels. The crypto’s recovery from a temporary setback, dropping below the $11 benchmark, to a robust trading price of $9.64 showcases its volatile yet upward trajectory.

The impressive year-over-year growth of 594%, coupled with a robust intraday gain, underscores THORChain’s strong market position. The crypto’s trading activity, buoyed by a high Fear/Greed score, indicates a bullish sentiment among investors, positioning it favorably against other leading cryptocurrencies, including Bitcoin and Ethereum.

THORChain continues to demonstrate sustainability.

In the last 2 years from ~10% to ~40% of income from liquidity fees.

Eventually it will be ~100%. pic.twitter.com/zbyDgpZf6V

— THORChain (@THORChain) March 26, 2024

THORChain’s resilience is further evidenced by its sustained performance above the 200-day simple moving average, suggesting a healthy return on investment across various metrics. Despite recent price swings, the optimism around THORChain remains intact, fueled by its considerable market cap and liquidity. The anticipation around its potential to breach past performance thresholds keeps the investor community keenly interested, marking THORChain as a noteworthy contender in the rapidly evolving crypto market landscape.

Ethereum

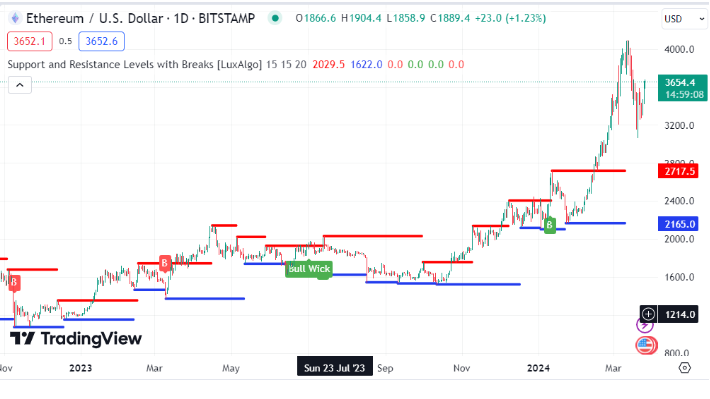

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is currently showcasing significant bullish trends, making it an attractive investment option for both seasoned and novice investors. The digital currency trades above the $3,550 mark, reflecting a strong upward movement from a previous low of $3,453, according to Coinmarketcap.

This upward trajectory is bolstered by a surge in trading volume, hinting at Ethereum’s increasing appeal among traders and investors alike. The broader cryptocurrency market’s positive momentum, led by Bitcoin, further enhances ETH’s investment allure.

Ethereum’s resilience is particularly noteworthy, overcoming short-term resistances and setting the stage for a sustained bullish trend. Technical analysis reveals Ethereum’s successful breach of key resistance levels, converting them into potential support zones.

This pattern of higher highs and higher lows is a classic hallmark of a bullish trend, suggesting Ethereum could soon test, and potentially break, the next significant resistance level at around $3,649.1. The formation of a bullish ‘bull wick’ on price charts emphasizes strong buying interest at lower price points, reinforcing the uptrend’s strength.

Moreover, the ETH/USD pair exhibits a promising bullish pattern on the 4-hour chart, hinting at a potential inverted head and shoulders formation, a classic sign of bullish reversal. With the Stochastic RSI pointing to strong momentum and the Chaikin Money Flow (CMF) indicating dominant buying pressure, Ethereum’s price is positioned for an upward breakout. Should Ethereum surpass the neckline near $3,555, the pathway towards the $4,000 mark appears increasingly plausible, especially with market sentiment leaning towards optimism as suggested by technical analysts.

The robust fundamentals of Ethereum, highlighted by its pivotal role in enabling smart contracts, DeFi protocols, NFTs, and a plethora of dApps, further substantiate the argument for investing in ETH. Ethereum’s transition from Proof-of-Work to Proof-of-Stake has not only enhanced its network efficiency but also its sustainability, aligning with broader environmental and technological trends.

The recent launch of BlackRock’s BUIDL tokenized fund on Ethereum underscores significant institutional interest, marking a notable milestone in Ethereum’s integration into traditional financial sectors.

one thing notable about this new @BlackRock fund on Ethereum

this isn't like old LARPs by governments who put some notional debt security onchain

this is the world's largest asset manager ACTUALLY putting $100M in USDC on the Ethereum blockchain

— DCinvestor (@iamDCinvestor) March 19, 2024

Given Ethereum’s current momentum, solid technical indicators, and strong underlying fundamentals, the case for investing in ETH now is compelling. The growth potential, coupled with increasing institutional involvement and continuous innovation within the Ethereum ecosystem, positions ETH as a leading candidate for portfolio inclusion.

As Ethereum navigates its way towards and possibly beyond the $4,000 threshold, the current market dynamics offer a potentially lucrative opportunity for investors to engage with one of the blockchain industry’s foundational technologies.

5. Toncoin

Toncoin continues the legacy of the original Telegram Open Network project, rebranded and advanced by the community after Telegram’s legal challenges. This project represents an evolution in blockchain technology, offering scalability and smart contract capabilities within a Proof-of-Stake consensus framework. The initial distribution via Proof-of-Work ensured a fair launch, setting the stage for a decentralized growth trajectory.

The TON Foundation’s Open League initiative exemplifies the active community and development focus around Toncoin. Launching its first season with substantial rewards, the initiative aims to foster innovation and engagement within the TON ecosystem. By incentivizing developers and users through competitions and quests, the Open League is poised to drive significant growth in network activity and value.

🚀 April 1st. Open League S1. $115M in $TON for community rewards!

The pilot season was just a teaser – time to double down on fun & rewards with the first full season, starting Apr 1st.

Want to be part of one of the biggest Web3 events ever? This 🧵 is for you 👇 pic.twitter.com/wDOg6ZwctI

— TON 💎 (@ton_blockchain) March 20, 2024

This program’s success, evidenced by substantial increases in total value locked (TVL) and daily active wallets during its pilot season, indicates Toncoin’s potential as a vibrant and growing blockchain community.

The 4-hour TON/Dollar chart indicates a rising wedge formation, which is traditionally interpreted as a bearish pattern in technical analysis. This pattern emerges when the price makes higher highs and higher lows within converging trend lines, hinting at a potential trend reversal. Notably, TON’s price has not yet broken out of the wedge, which suggests that traders might be on the lookout for either a breakout or a breakdown from this pattern to confirm the future direction of the price movement.

The Moving Average Convergence Divergence (MACD) is below the signal line but above zero, indicating a loss of bullish momentum in the short term, yet the overall trend from a larger perspective might still be considered bullish. If the MACD starts to ascend and cross above the signal line, it could be a buying signal, while further divergence below could confirm a bearish move.

The Aroon indicator, which is designed to measure the strength of a trend and the likelihood of its continuation, shows the Aroon Up (blue line) below the Aroon Down (orange line). This can be a sign of weakening upward momentum and potentially the start of a downward trend.

Price action is currently in the upper region of the wedge, and if the price breaks below the wedge, it could indicate a shift to a bearish trend. Conversely, if the price maintains within the wedge or breaks upward, the current bullish trend may continue. Traders might watch for these signs closely to determine their next steps. Given these mixed signals, it would be prudent to monitor TON’s price action for a clearer directional bias before making trading decisions.

The emergent bullish sentiment in the cryptocurrency market, bolstered by Bitcoin’s impressive rally, has catalyzed interest in a group of promising altcoins. Fetch.ai capitalizes on the AI trend with exponential growth, while Injective Protocol innovates within DeFi, offering unique interoperability solutions. THORChain bounces back with strong gains, and Ethereum continues to break resistance levels, eyeing the $4,000 mark with robust fundamentals and institutional backing.